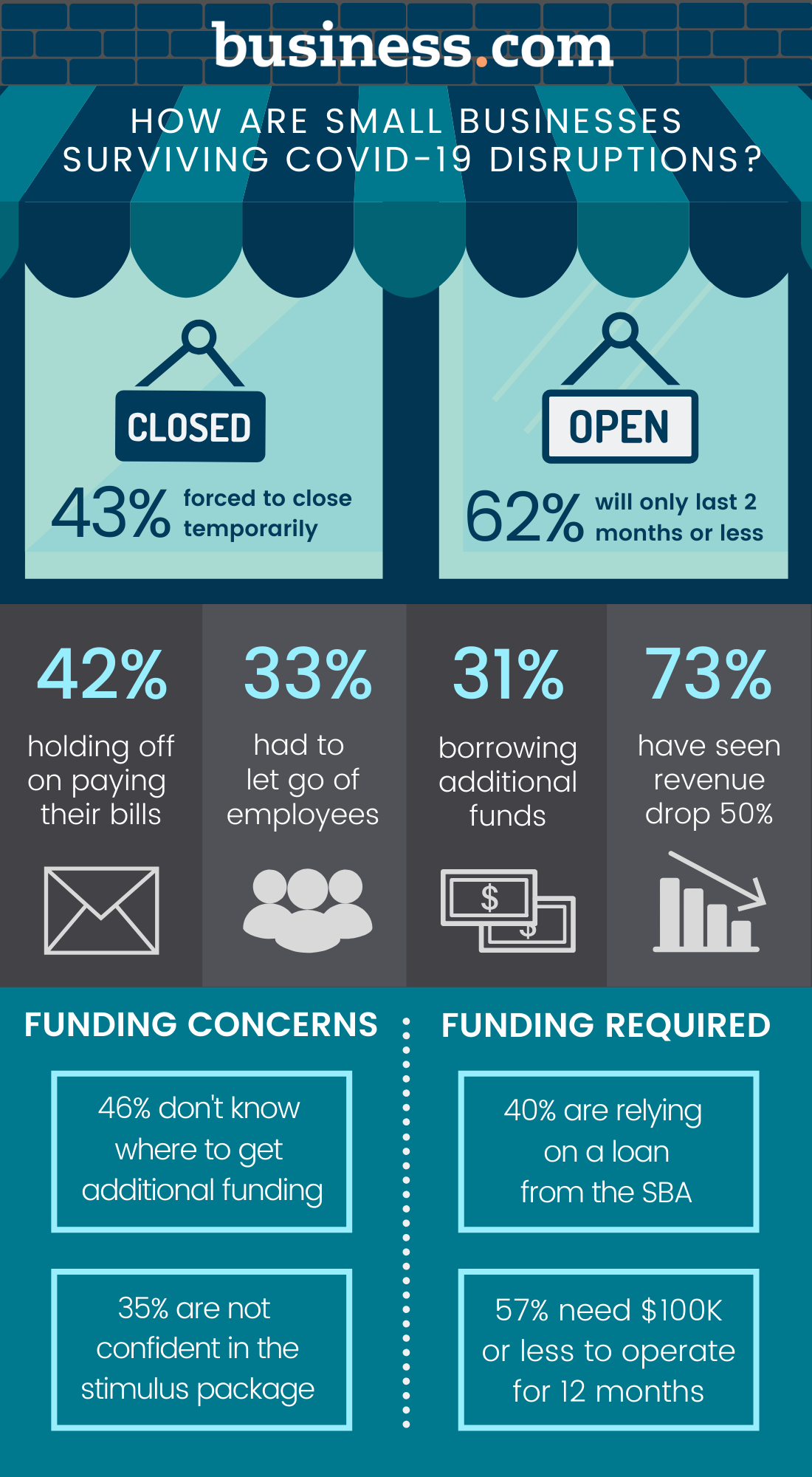

Small business owners are facing the stark reality that their livelihoods are in jeopardy. Nearly 62% of small business owners who participated in a new online business.com survey said their businesses have just two months or less in the current economic conditions before they go under. Already, 73% of respondents have seen their revenues drop by more than 50%, and 43% have already closed their businesses at least temporarily and have no incoming revenue at all.

The survey was taken from business.com readers who opted in from the business.com website or email newsletter between March 19 and 30 in the midst of the coronavirus outbreak. The respondents included more than 350 business owners from across the country, representing numerous industries.

Many small business owners are running out of time.

Thirty-seven percent of survey respondents reported that they may only have one week to a month without any assistance or incoming revenue before they are forced to shutter their businesses, and another 24% said they could make it one to two months without assistance. The respondents were overwhelmingly very small businesses, with 59% saying they operated businesses with five or fewer employees – a subset of American businesses that have been hit particularly hard by the recent economic downturn.

The responses from the last several weeks mark a drastic shift in business owners' confidence, as internal business.com data showed a remarkably steady mindset from small business owners in the years leading up to the coronavirus outbreak. Data from 2017 through 2019 showed consistent growth-oriented reasons for businesses seeking loans. Over the course of those three years, 30% of businesses sought loans for expansion efforts and acquisitions, 15% needed loans for equipment purchases, 14% sought assistance with real estate purchases, 13.5% needed money to remodel or enhance existing facilities, and 12.4% sought a business loan to consolidate existing debt.

In the wake of the COVID-19 outbreak, however, businesses are now left wondering how they can receive assistance just to keep their businesses afloat. That near-whiplash effect signifies how sudden the small business community's needs shifted as a result of the crisis.

Michael Hicks, director of Ball State University's Center for Business and Economic Research, said the smallest businesses don't have the buying power of larger businesses and corporations. Without the ability to gain access to more capital when things get harder, small businesses are left having to find places to cut to stay afloat.

"It's easier for [larger businesses] just to scale their enterprise ... they have more assets to hold on to, and they probably have a closer relationship with the bank," Hicks said. "The problem for these small businesses is not [only] how you're going to pay the managers and employees, but how are you going to pay the owners of the property? How are they going to sustain themselves?"

Among the respondents who said they only had a month, at most, in the current economic climate without assistance, 67% employed five or fewer workers, while nearly 17% had six to 10. Less than 2% reported having 100 or more employees on staff.

Hicks expects many businesses will have a hard time getting back up and running when things finally get back to normal, stating that reopening a small business "is not a trivial expense."

"Economists stress that one of the problems that can come up in this business cycle is that you can lose a lot of unmeasured organizational capital ... [like] the client list for a dental office or the clients a hair salon builds up over four years," he said. "When those go away, reestablishing them is very costly. I think the fear that many economists have is that that's what we're going to lose from this."

Eventually, things can get better.

One small bit of positive news is that most respondents believe they don't need an exorbitant amount of funding in order to remain open for an additional year. Nearly 57% said they would need a maximum of $100,000 to keep their businesses running for another 12 months, while another 25% said they would need between $100,000 and half a million in funds.

Looking back at our data from 2017 through 2019, the number of small businesses seeking up to $100,000 in business loans was 21.7%; this most recent data marks a 30% increase. In comparison, the number of businesses that sought loans between $100,000 and $500,000 was approximately 42%. It should be noted, however, that those loan requests were intended for business growth rather than business survival.

Thanks to the recent passage of the CARES Act, small businesses throughout the country will have access to government loans created specifically to address the COVID-19 threat. The $2 trillion stimulus package includes $350 billion in forgivable loans, as well as $17 billion for relief of existing SBA loans.

"This legislation provides small business job retention loans to provide eight weeks of payroll and certain overhead to keep workers employed," said Treasury Secretary Steven Mnuchin in a press release. "Treasury and the Small Business Administration expect to have this program up and running by April 3 so that businesses can go to a participating SBA 7(a) lender, bank, or credit union, apply for a loan, and be approved on the same day."

One resource for small businesses with fewer than 500 employees looking for up to $100,000 may be the Paycheck Protection Program, which will provide loans to businesses that will ultimately be forgiven if they refrain from letting any employees go during the crisis and use at least 75% of the funds on payroll. These loans will be available through June 30, and will also cover things like rent, mortgage interest and utilities.

"Speed is the operative word; applications for the emergency capital can begin as early as this week, with lenders using their own systems and processes to make these loans," SBA Administrator Jovita Carranza said. "We remain committed to supporting our nation's more than 30 million small businesses and their employees so that they can continue to be the fuel for our nation's economic engine."

Editor's note: Looking for a small business loan? Fill out the questionnaire below to have our vendor partners contact you about your needs.

Small businesses are being forced to perform financial triage.

With less money coming in, a greatly reduced workforce, and continued uncertainty as weeks of disruption potentially turn into months, our respondents said they may be forced to make drastic decisions to mitigate the financial impact.

Nearly 42% said they either planned to hold off on paying certain bills or already have begun withholding payments, making that the top response to the question of how business owners will mitigate the immediate impacts to their businesses. While withholding bill payments may sound extreme, many providers have announced forbearance and forgiveness measures that could extend payment periods in the wake of COVID-19. The fact that many of our respondents admitted to paying some bills and not others didn't surprise Hicks, who said the move could help some businesses stay afloat a little while longer.

"I'm going to hold off on paying anybody I can and delay just to hold on to cash for two reasons," he said. "One is that doing so allows me to keep [the business] running for longer, and, second, it potentially gives me the revenue to reopen."

Along with not paying bills, 33% said they were laying off employees, 32% said they were cutting back on nonemployee costs, and nearly 31% said they intended to borrow additional money.

Hicks suggested that the relatively low figure in funding requirements that most respondents said they needed to remain open for a year – $100,000 or less – could mean a few things. Either respondents were running "mothball companies" that only operate during certain times of the year, the owner decides to stick things out and reduces staff to a skeleton crew, or there's some optimism that the COVID-19 threat won't last an entire year.

"When people talk about making a free year, what they really mean is, 'I don't need to be open for a year, but I'm not going to actually be 100% closed for that year,'" he said. "I recently drove by my local butcher shop and they're closed, but you can call in to place an order, so they're doubtless making some money. But they probably laid off everyone but the owner, you know, so maybe he could pay himself to be around for a year, but nothing else."

While accruing additional debt to cover costs in a time of need is often necessary, lending money to an entity that may not be able to pay that debt back can have its consequences. While banks will be buoyed by the Federal Reserve, if things go particularly sideways, things could go bad if more and more businesses default on their bills and loans. If businesses end up shutting down for good as a result of being unable to pay their bills, Hicks warned that banks are going to end up owning "a lot of assets that are worth a lot less than they initially lent the business owner for."

"My concern is that we would have much more difficulty restarting the economy because so many banks are going to own so much bad property, like we saw in 2009 and 2010 when a lot of the property the banks owned wasn't worth anything," Hicks said.

Social distancing has cratered revenue streams.

As millions of Americans have been urged to sequester themselves to their homes to help "flatten the curve," small businesses that rely on foot traffic have taken a massive hit. According to our survey, 74% of respondents report an inability to get customers through their doors.

One respondent told us their childcare service had to close all three locations because they went from full attendance to zero. "Our rents are $25,000 per month, and my payroll is about $40,000," they said. "With no income coming in, it's impossible to pay it. We will not be able to survive the upcoming months without help."

Another major issue our respondents reported experiencing was an ongoing disruption to their supply chains. As COVID-19 made its way around the planet, it hit major manufacturing and agricultural countries particularly hard. China and Italy, two of the hardest-hit countries in the world, regularly provide American businesses with products and supplies needed to keep businesses moving. While major corporations are likely able to weather that kind of disruption, Hicks again points to smaller businesses having a harder go of things – especially in particular industries.

"McDonald's has been affected by this, but from what I can tell driving by, they're packed with people driving through every day," he said. "They may have fewer people working, but they probably haven't shifted their consumption a lot. The sit-down restaurants, however, are more likely to be buying fresh fruits or vegetables. "I think the big supply shocks for smaller businesses are going to be things like ice delivery, maybe the food delivery, the wine distributor, the local suppliers that pull up into local businesses."

The government still needs to do more.

While the government's attempts to help small businesses are a big first step, many believe the Trump administration hasn't done enough to solve the problem. Thirty-five percent of our respondents were "not confident at all" that the stimulus package would help their business.

One key factor, according to Hicks, is the fact that many people see the stimulus package as an "overgenerous" effort to help corporations, since it offered $500 billion to major industries like airlines and hospitality.

While some state governments have put a halt on bankruptcy proceedings and issued rent freezes, among other steps, the potentially slow response from the federal government could be a major problem. Institute for Workplace Skills and Innovation's CEO Nicholas Wyman said the fact that the money is coming down the pipe is great, but it could be a case of too little, too late for many business owners.

"There's been a lot of talk about the stimulus packages at both federal and state levels, and promises of money flowing from the stimulus that will assist business. But for many companies, time is running out," he said. "Many businesses have heard the big numbers being touted around, but they know words alone won't save them. It's about tangible support flowing to these companies fast."

When asked where they would seek funding (with multiple responses allowed), 45.7% of small businesses said they didn't know where they would go to find extra funding. Other responses indicated that

- 4% of respondents would apply for SBA loans

- 6% would apply for a business loan from their bank or credit union

- 19% would use their credit cards to float their businesses

- 4% would turn to friends and family for help

Click the slideshow below to see all the results of our survey.