A statement of shareholder equity is a section of the balance sheet that reflects the changes in the value of the business to shareholders from the beginning to the end of an accounting period.

If the statement of shareholder equity increases, it means the activities the business is pursuing to boost income are paying off. If the statement of shareholder equity decreases, it may be time to rethink those initiatives.

What is a statement of stockholders' equity?

A statement of stockholders' equity is another name for the statement of shareholder equity. This section of the balance sheet is also known as a statement of shareholders' equity or a statement of owner's equity. It gives shareholders, investors or the company's owner a picture of how the business is performing, net of all assets and liabilities.

The statement of stockholders' equity is the difference between total assets and total liabilities, and is usually measured monthly, quarterly, or annually. It's found on the balance sheet, which is one of three financial documents that are important to all small businesses. The other two are the income statement and the cash flow statement.

Stockholders' equity can increase only if there are more capital contributions by the business owner or investors or if the business's profits improve as it sells more products or increases margins by curbing costs.

Some small business owners may overlook the statement of stockholders' equity if they are focused only on money coming in and going out. But income shouldn't be your only focus if you want a good idea of how your operations are faring.

"The statement of shareholder equity tends to be overlooked because people focus on the profit-or-loss statement or cash flow," Craig M. Steinhoff, a certified public accountant and a member of the American Institute of CPAs' Consumer Financial Education Advocates, told business.com. This section is important, however, because it helps business owners evaluate how their business is doing, what it's worth, and what are good investments, he said.

The statement of stockholders' equity may intimidate some small business owners because it's a little more complicated than the income statement, but broken down, it's essentially what your enterprise has made that remains in the business.

"Business owners overlook the statement of shareholder equity because they don't understand it," Steinhoff said. "But it's easier to invest the time in educating yourself, whether through researching online, talking to an advisor, or finding a mentor. This is extremely important. It's never too late to learn."

What is stockholders' equity?

When you take all of the company's assets and subtract the liabilities, what remains is the equity. For a company with stock shares, the equity is owned by the stockholders. The statement of equity is simply the part of a balance sheet or ledger that clearly calculates and explains the stockholders' (or shareholders') equity.

Components of stockholders' equity

Stockholders' equity has a few components, each with its own value and meaning.

Share capital

Share capital is the cash a company raises by issuing stock. In an initial public offering, a set amount of stock is sold for a set price. After that, the stock can be traded freely, but the money that is paid directly to the company for that initial offering is the share capital.

Retained earnings

Retained earnings is the amount of money left in the business after the shareholders are paid dividends. With dividend stocks, shareholders are entitled to a percentage of the company's profits. The company still needs to calculate how much money it has to work with after these payments are made, and that calculation is the retained earnings.

Net income

Net income compares profits to expenses and deductions. In short, the net income is the money left after you subtract expenses and deductions from the total profit. In this case, profit is the amount of money made after subtracting the cost of operations.

Dividends

Dividends refer to funds paid to shareholders. Investors who own stock in a company own a portion of the business. As such, they are entitled to a percentage of the profits. A dividend is the amount of money paid per share of stock, and it is not necessarily equal to the profit. Instead, the company will set aside a portion of its profits to pay dividends, and that portion is usually outlined in the stock agreement.

Who uses a statement of stockholder equity?

The statement of stockholder equity is used by companies of all types and sizes, ranging from small businesses with just a handful of employees to large, publicly traded enterprises. For companies that aren't public, the statement of stockholder equity is often considered the owner's equity.

"If you have more than a sole proprietorship, it's always a good idea to have a statement of stockholder equity," said Meredith Stoddard, life events experience lead at Fidelity Investments. "It's an important document that spells out where the assets and liabilities are, and who owns what."

Why should you use a statement of shareholder equity?

In both prosperous and challenging times, small business owners need to have an idea of how their business is faring over a certain period. Without a statement of shareholder equity, that is difficult to do. According to Steinhoff, here are three reasons why a statement of shareholder equity is a valuable tool for gauging the health of a business."

1. It can help you make financial decisions.

Listing how much the business is worth after expenses are paid is valuable for planning purposes. A statement of shareholder equity can tell you if you should borrow more money to expand, whether you need to cut costs or whether you'll make a profit on a sale. It can also help you attract outside investors who will undoubtedly want to see that statement prior to injecting capital into your enterprise.

2. It can tell you how well you're running your business.

A statement of shareholder equity is useful for gauging how well the business owner is running the business. If stockholder equity declines from one accounting period to the next, it's a telltale sign that the business owner is doing something wrong.

3. It can help you get through financial difficulties.

The statement of shareholder equity is also important in trying times. It tells you if you didn't make enough to sustain operations. It can also reveal whether you have enough equity in the business to get through a downturn, such as the one resulting from the COVID-19 pandemic. The statement of shareholder equity shows whether you are on sound enough footing to borrow from a bank, if there's value in selling the business and whether it makes sense for investors to contribute.

What does the statement of stockholder equity include?

The components of the statement of stockholder equity vary depending on the size of the business and how it operates. Here are some of the elements it can include:

- Preferred stock. This is a share in the company (or an ownership stake) that is issued as stock or equity. Preferred stockholders are held in a higher esteem than common stockholders when it comes to dividends and the distribution of assets.

- Common stock. This is also a share in the company, but it takes a back seat to preferred stockholders when it comes to paying out equity. For example, if the business decides to liquidate, preferred stockholders will get paid before common stockholders do. However, common stockholders tend to have voting rights, whereas preferred stockholders usually don't.

- Treasury stock. These are the shares that the company buys back, whether to prevent a rival from trying to take over the company or to drive the stock price higher. This type of stock typically pertains to publicly traded companies.

- Retained earnings. These are the net profits on the income statement that do not get paid out to shareholders or as the owner's draw. Retained earnings are used to reinvest in the business. For example, they can be used to purchase new equipment, to invest in research and development, or to pay down costly debt.

- Contributed capital. Often referred to as additional paid-up capital, this is the extra amount investors pay for shares over the par value of the business. This additional capital is created when a company issues new shares, and it can be reduced when the company buys back its own shares.

- Unrealized gains and losses. These are the gains and losses a business sees as a direct result of a change in the value of its investments. Unrealized gains occur when the business has yet to cash in those gains, while unrealized losses are those reductions in value before the investment is unloaded.

How do you create a statement of shareholder equity?

The statement of stockholder equity typically includes four sections that paint a picture of how the business is doing.

- Section One: Equity. The first section shows the equity of the business at the beginning of the accounting period.

- Section Two: New equity infusions. This section lists any new investments that shareholders or owners made to the company for the year. Net income is also included in this calculation.

- Section Three: Subtractions. This section subtracts all dividends paid out to investors and any net losses.

- Section Four: Equity balance. The final section shows your ending equity balance for the period you are tracking.

The heading on the statement of shareholder equity should have the company name, the title of the statement, and the accounting period to prevent any confusion later when you are searching for these financial statements.

Business owners can create a physical shareholder statement of equity to go into the balance sheet, using Excel, a template or accounting software that automates a lot of the work.

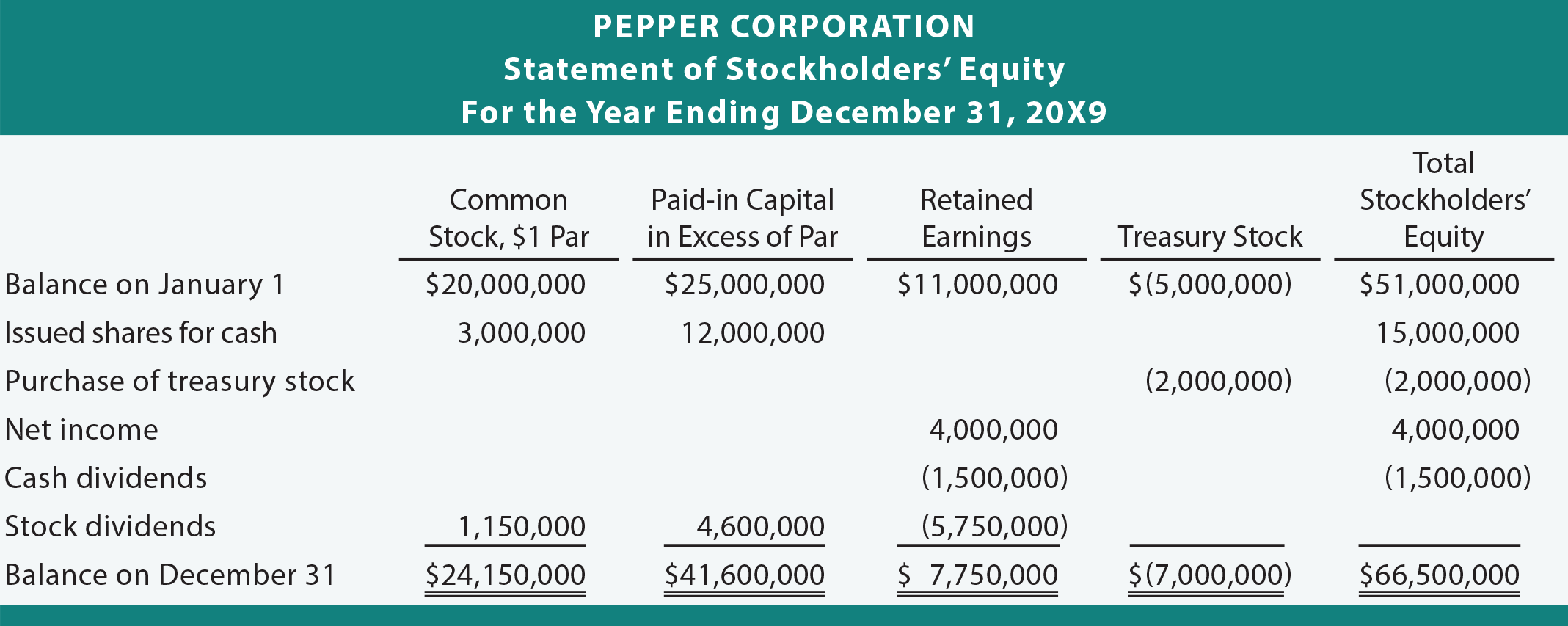

Here is an example of a statement of stockholder equity provided by PrinciplesofAccounting.com: